By: GoldCore

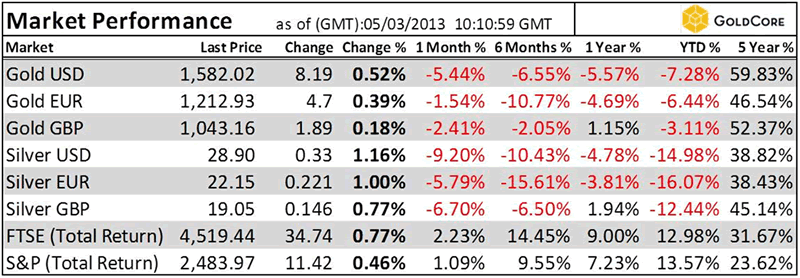

Today?s AM fix was USD 1,584.25, EUR 1,214.82 and GBP 1,044.33 per ounce.

Yesterday?s AM fix was USD 1,578.00, EUR 1,214.13 and GBP 1,049.06 per ounce.

Silver is trading at $28.93/oz, ?22.30/oz and ?19.16/oz. Platinum is trading at $1,588.50/oz, palladium at $722.00/oz and rhodium at $1,200/oz.

Gold fell $1.80 or 0.11% yesterday in New York and closed at $1,573.80/oz. Silver slid to a low of $28.43 and finished with a loss of 0.07%.

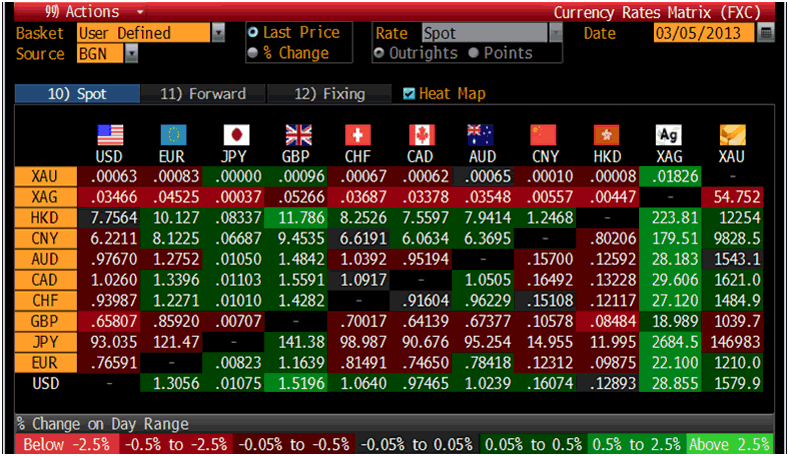

Cross Currency Table ? (Bloomberg)

Gold snapped four days of losses due to concerns that central banks from the U.S. to the UK, Europe and Japan will continue ultra loose monetary policies and currency debasement.

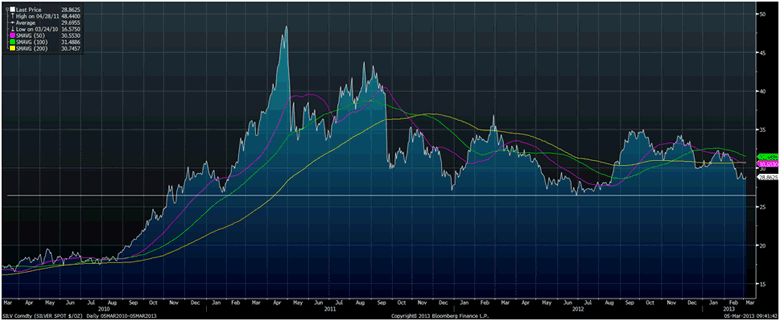

Silver Spot $/oz 05MAR2012-05MAR2013 - (Bloomberg)

Silver, platinum and palladium also advanced after recent falls.

Soci?t? G?n?rale has issued a research note saying that investors looking to allocate funds to the precious metals may buy silver as a ?cheaper alternative? to gold.

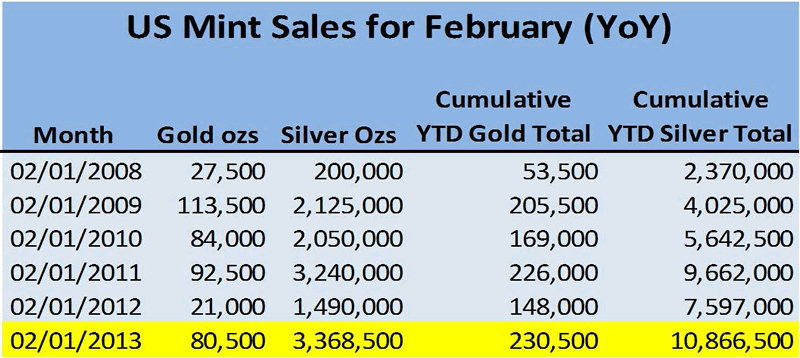

In a report e-mailed today and picked up by Bloomberg, the bank cites the ?healthy? improvement in silver coin demand and exchange-traded product purchases recently.

The bank says that measurable silver investment in 2013 is up by more than 30% and if sustained, this year?s surplus should be absorbed. This could lead to a silver deficit.

Silver eagle bullion coin sales soared to a record amount in February 2013 - totaling 3,368,500 ounces.

February?s record sales followed record coin sales in January. Year-to-date silver sales for the U.S. Mint are 10.8 million ounces, which is over 10% higher than the next best period from 2011. The record sales in that period may have contributed to silver's surge to over $49/oz on the 28th of April 2011.

Silver support is at the $26/oz level and with silver?s supply demand fundamentals remaining even more compelling than gold, investors are diversifying their precious metal holding by going long on silver.

Gold remains nearly double its nominal high of $850/oz in January 1980. Silver is close to half of its nominal high in 1980 and its recent high in April 2011 ? both close to $50/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL E info@goldcore.com |

UK |

IRL +353 (0)1 632 5010 W www.goldcore.com |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

? 2005-2013 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Source: http://www.marketoracle.co.uk/Article39330.html

metro north taco bell taco bell Breezy Point Seaside Heights nj transit PSEG

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.